Report

Understanding Competitive Wages and Local Candidate Pool Insights

Why do people work? The straightforward answer is that most of us work for pay. Of course, there are many other factors that influence our choice of job, such as how well we perform or how fulfilled we feel in the role.

However, in the 2020s, determining fair compensation has become increasingly complex. Inflation, market instability, and shifting worker expectations have made it challenging for employers to figure out the right pay rates to attract and retain talent.

National Pay Rates for Common Industrial Jobs

| Job Title | National Mean Hourly Wage |

| Production Worker | $19.90 |

| Shipping & Receiving Specialist | $17.00 |

| Quality Inspector | $19.50 |

| Manufacturing Assembler | $18.00 |

| Warehouse Worker | $16.50 |

When reviewing the national mean hourly wages for five common job titles in the industrial field, it’s important to recognize that these figures provide a broad overview but don’t tell the whole story. While this data offers a general benchmark, it doesn’t account for the regional variations in wages driven by differing costs of living across states.

Cost of Living Differs By State and Region

| State | Annual Mean Wage (All Occupations) | Buying Power of $100 |

| Alabama | $53,400 | $112.20 |

| Alaska | $69,880 | $98.00 |

| Arizona | $63,040 | $100.10 |

| Arkansas | $51,250 | $113.40 |

| California | $76,960 | $87.50 |

| Colorado | $71,960 | $97.70 |

| Connecticut | $73,740 | $93.60 |

| Delaware | $65,990 | $102.00 |

| Florida | $60,210 | $97.90 |

| Georgia | $61,250 | $104.20 |

| Hawaii | $65,030 | $89.20 |

| Idaho | $55,640 | $108.20 |

| Illinois | $67,130 | $98.70 |

| Indiana | $56,420 | $108.20 |

| Iowa | $56,400 | $111.60 |

| Kansas | $56,270 | $110.00 |

| Kentucky | $54,030 | $110.60 |

| Louisiana | $53,440 | $109.40 |

| Maine | $60,000 | $99.20 |

| Maryland | $73,620 | $95.00 |

| Massachusetts | $80,330 | $90.60 |

| Michigan | $60,600 | $106.60 |

| Minnesota | $66,700 | $102.30 |

| Mississippi | $47,570 | $112.70 |

| Missouri | $57,580 | $108.90 |

| Montana | $55,920 | $109.70 |

| Nebraska | $58,080 | $110.20 |

| Nevada | $58,900 | $103.60 |

| New Hampshire | $66,110 | $92.40 |

| New Jersey | $73,980 | $91.20 |

| New Mexico | $57,520 | $109.00 |

| New York | $78,620 | $92.40 |

| North Carolina | $59,730 | $105.80 |

| North Dakota | $59,050 | $111.30 |

| Ohio | $59,890 | $108.50 |

| Oklahoma | $53,450 | $111.20 |

| Oregon | $66,710 | $93.40 |

| Pennsylvania | $61,920 | $103.80 |

| Rhode Island | $66,610 | $95.30 |

| South Carolina | $54,250 | $106.40 |

| South Dakota | $53,230 | $112.20 |

| Tennessee | $56,030 | $108.20 |

| Texas | $61,240 | $102.50 |

| Utah | $61,070 | $105.50 |

| Vermont | $62,780 | $98.90 |

| Virginia | $70,050 | $97.90 |

| Washington | $78,130 | $90.20 |

| West Virginia | $52,200 | $110.80 |

| Wisconsin | $59,500 | $107.70 |

| Wyoming | $57,930 | $108.10 |

Looking at the chart above, it’s clear that wages and the “buying power” of a dollar vary widely from state to state. For example, a $100 bill will allow you to purchase a greater quantity of groceries in Iowa than in California. Offering wages that reflect both typical state pay and the cost of living is essential for attracting talent. But that’s only part of the equation.

Even within the same state, expected salaries and the cost of living can vary greatly between counties. This underscores the importance of using localized data to set pay rates in today’s economy. The value of a dollar changes significantly based on location, meaning a competitive wage in one area might not be enough in another. To set truly competitive wages, it’s crucial to factor in both national trends and local economic conditions.

Factors That Impact Pay Rate

Employers must carefully consider various factors that impact pay rates because these elements directly influence their ability to attract and retain talent in a competitive labor market.

As economic conditions and workforce expectations evolve, companies need to offer compensation that not only reflects the cost of living and inflation but also meets the cultural and financial needs of their employees. By aligning wages with these factors, businesses can ensure they remain competitive, reduce turnover, and build a stable, motivated workforce that drives their success.

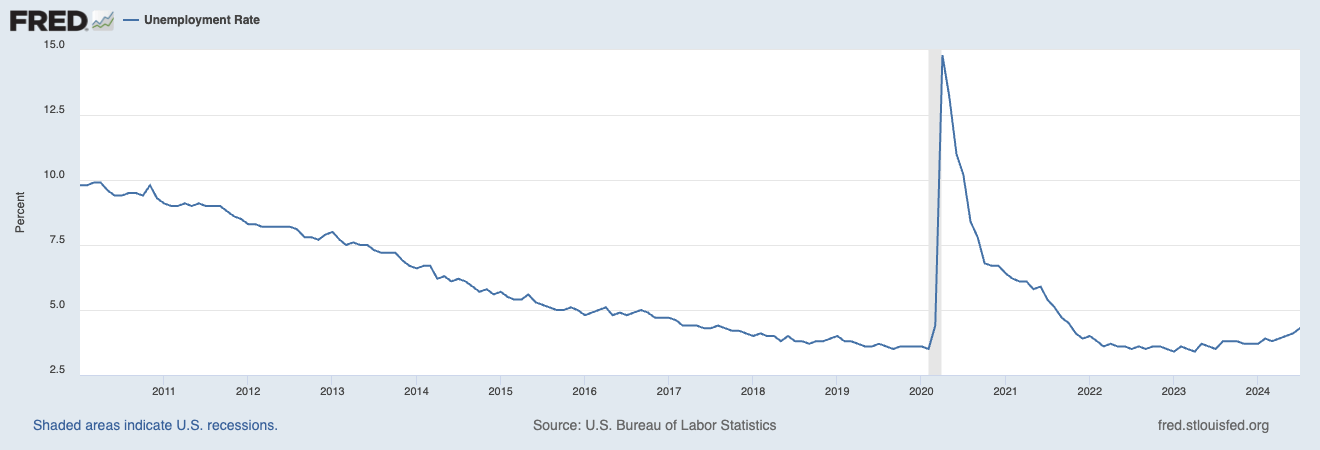

Unemployment Rate

As demand for workers grows, wage expectations rise accordingly. In markets with low unemployment, where competition for labor is intense, employers must offer competitive pay to attract and retain top talent. Failing to do so risks losing potential hires to competitors with better compensation packages. Moreover, in a tight labor market, turnover rates can increase if employees perceive better opportunities elsewhere, further emphasizing the need for competitive wages.

The U.S. is currently experiencing a period of low unemployment, with most people already employed. Although there has been a slight uptick in the unemployment rate, it remains relatively low, underscoring the ongoing need for employers to offer compelling wages to secure the workforce they need.

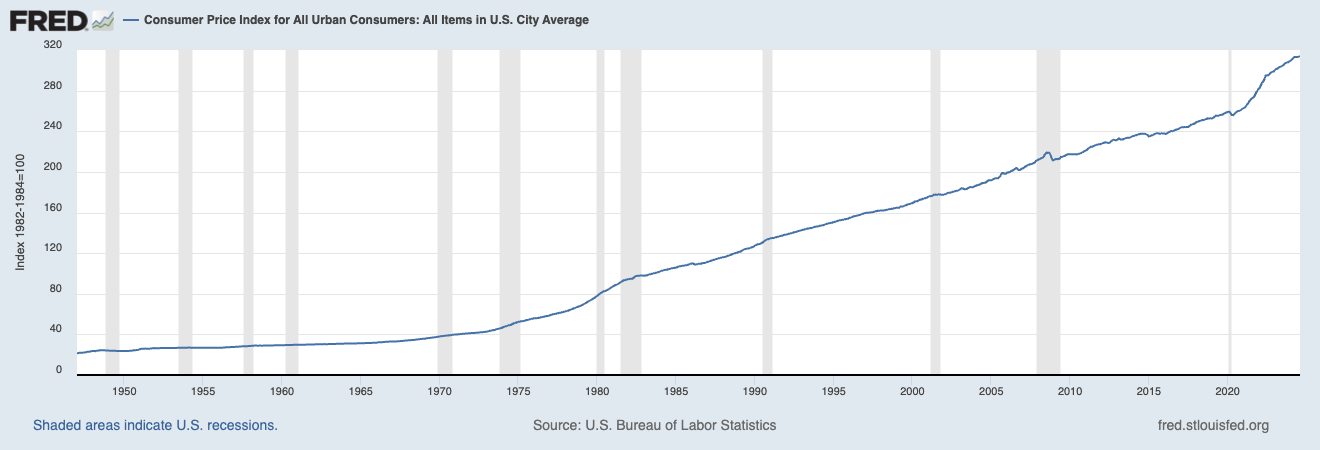

Inflation

Consumer Price Index for All Urban Consumers: All Items in U.S. City Average

Inflation directly impacts the cost of living, which in turn influences worker expectations for higher wages. As prices for essential goods and services rise, employees require higher compensation to maintain their standard of living. If wages do not keep pace with inflation, workers may feel undervalued and become more likely to seek employment elsewhere. Employers must continuously monitor inflation trends and adjust wages accordingly to retain talent and ensure that employees feel financially secure.

Cultural Expectations of Workers

Today’s workforce, particularly younger generations, expects wages that not only reflect their skills and experience but also align with the cultural and economic realities of their environment. Employees are increasingly aware of their worth in the market and expect compensation packages that meet or exceed these expectations. Employers who understand and respond to these cultural shifts are better positioned to attract and retain top talent. Failure to meet these expectations can lead to dissatisfaction, disengagement, and higher turnover rates.

Competitor Pay Rates

Monitoring and matching or exceeding competitor pay rates within a 25-mile radius is essential for attracting and retaining talent in a competitive market. Workers often compare job offers based on salary, and if your pay rates are lower than those of nearby competitors, you may struggle to attract qualified candidates. Additionally, competitive pay rates signal to potential employees that your company values its workforce, which can enhance your reputation as an employer of choice. Regular benchmarking against local competitors helps ensure your wage offerings remain attractive.

Cost of Living

Workers need to earn enough to cover basic necessities like rent, utilities, and medical expenses, making it crucial for wages to align with the cost of living in the job’s location. In areas with a high cost of living, employees will demand higher wages to meet their financial obligations. Conversely, in regions with a lower cost of living, employers may have more flexibility in setting wages. However, it’s important to balance this with the need to attract skilled workers who may be considering opportunities in higher-paying regions.

Family Responsibilities

Workers with children, particularly single parents, require higher wages to support their families, as the financial demands of raising children are significant. Employers should consider the financial needs of these workers when setting pay rates, recognizing that a living wage must cover not only the employee’s needs but also those of their dependents. Offering competitive wages and family-friendly benefits, such as childcare support or flexible working hours, can make your company more attractive to workers with family responsibilities. This approach not only helps in recruiting talent but also in retaining employees who might otherwise leave for better-paying opportunities.

- The 2020 Census found the average American family with dependents has 1.93 children.

Factors that Impact How Workers Assess Your Pay Rate

Benefits

Workers may be willing to accept lower wages if the benefits package offered is exceptional, as benefits effectively add value to their overall compensation. Affordable healthcare, retirement plans, and other perks can make a lower-paying job more attractive, as they provide long-term security and support. Benefits are particularly important in industries with physically demanding or high-stress jobs, where workers may prioritize health coverage and work-life balance over a higher salary. By offering a comprehensive benefits package, employers can enhance job satisfaction and reduce turnover.

Career Advancement Opportunities

Career-oriented workers may accept lower pay initially if there is a clear, well-defined path to higher earnings and career progression. Employers who provide opportunities for skill development, training, and promotions can attract ambitious employees willing to start at a lower wage in exchange for future growth. It’s important for employers to clearly communicate these opportunities and ensure that the career ladder is accessible and achievable. Without visible advancement prospects, workers may become dissatisfied and seek better-paying opportunities elsewhere.

Work-Life Balance

A balanced work-life environment is increasingly important to workers, especially as remote and flexible work options become more common. Employees today prioritize roles that allow them to manage their personal and professional lives effectively, even if it means accepting a slightly lower salary. Employers that offer flexible schedules, remote work options, or generous leave policies can attract and retain employees who value work-life balance. This approach can be particularly effective in industries where long hours or physical demands are common, as it enhances overall job satisfaction.

“Fun” Element

Jobs that are enjoyable and easy to do can afford to offer lower pay, as these positions are often highly sought after. For example, creative or passion-driven roles, such as those in the arts or non-profit sectors, may attract workers who are willing to accept less pay for the opportunity to work in a fulfilling environment. However, it’s important to note most industrial or manufacturing jobs do not fit this category. Employers in these sectors must find other ways to make their roles attractive.

Workplace Culture

A negative work environment requires higher pay to attract and retain employees, as workers need to be compensated for enduring poor conditions. However, even with high pay, a toxic workplace culture can lead to high turnover, as employees prioritize their mental and emotional well-being. In contrast, a positive work culture can lead to higher job satisfaction, reducing the need for employers to offer inflated wages. Companies that invest in creating a supportive and inclusive work environment are more likely to retain talent, even if their pay rates are not the highest in the market.

Addressing Common Misconceptions About Recruiting and Pay Rates

Misconception: “I am just recruiting workers in my direct industry.”

Truth: Recruiting is not limited to your industry alone; you’re competing with other sectors that require similar skill sets. For instance, an entry-level warehouse worker may have experience in hospitality or retail, meaning these industries are all vying for the same talent. To attract the best candidates, your pay rate needs to stand out across industries, not just within your own.

Misconception: “There are workers waiting to accept my job.”

Truth: With the unemployment rate remaining low, most potential candidates are already employed. This means you need a compelling pay rate and benefits package to entice workers to leave their current positions. Competitive compensation is a key factor in persuading them to consider a job switch. .

Misconception: “I can look at national or state trends to determine a fair pay rate.”

Truth: Pay rates must be tailored to your local market, as each area has its own unique economic conditions. Factors like local rent, cost of living, and transportation options significantly impact what constitutes a fair wage. A 25-mile radius around your business is the most relevant area to analyze, ensuring your pay rates are competitive within the specific local context.

Misconception: “Once I find the right pay rate, I can move on.”

Truth: The job market has evolved rapidly in the 2020s, requiring constant reassessment of pay rates to stay competitive. What works today may not be effective tomorrow. That’s where Ōnin and your staffing company come in—they help you continuously evaluate and adjust your compensation strategies to ensure you remain attractive to potential employees in a fast-changing environment.

How Ōnin Helps You Determine Wages: A Step-by-Step Guide

- Local Market Analysis

Ōnin conducts a detailed analysis of your local job market, using data to evaluate the cost of living, competitor pay rates, and other crucial factors. This ensures your wages are competitive within your specific 25-mile radius. - Recruiting Strategy Guide

We provide you with a customized recruiting strategy guide that takes an in-depth look at how your job compares to others in the area. This guide helps you understand where your pay rates stand and what adjustments may be needed. - Employer of Choice Strategy

Together, we identify and categorize the unique benefits you offer to workers, breaking them down into three key categories to enhance your appeal as an employer. This strategy positions your company as the top choice for candidates. - On-the-Ground Market Knowledge

Using our brick-and-mortar locations and direct interactions with candidates, Ōnin applies real-world insights to your wage strategy. This ensures our recommendations are grounded in current, local market conditions rather than remote or generalized data. - Ongoing Refinement

As the labor market evolves, so do we. Ōnin continually refines your wage and recruiting strategies to keep you competitive, adapting to changes and ensuring you attract and retain the best talent.

Why Finding the Right Pay Rate Matters

Determining the right pay rate isn’t just about following national or state trends; it’s about understanding the unique economic conditions in your specific location.

That’s where Ōnin stands out.

We don’t just provide general pay rate advice—we deliver localized pay rates tailored specifically for your business. This approach ensures you’re offering competitive wages that resonate with workers in your immediate area, giving you a significant advantage in attracting and retaining top talent.

In today’s complex job market, where factors like cost of living, inflation, and worker expectations vary widely even within a single state, having pay rates finely tuned to your local market is invaluable. National averages might provide a starting point, but they won’t help you compete effectively in your local talent pool. With Ōnin, you get a personalized analysis that considers the unique characteristics of your 25-mile radius, ensuring your compensation strategy is both competitive and relevant.

This localized focus means you’re not just offering wages that are “good enough”—you’re offering wages that are precisely what top candidates in your area are looking for. This level of detail helps you stand out as an employer of choice, reducing turnover and building a strong, motivated workforce that drives your business forward.

Ready to apply these insights to your business?

Request your Customized Recruiting Strategy Guide today, and let Ōnin help you set the perfect pay rates to secure the talent you need.